What we can help with

Secure your financial future with comprehensive advice

Tailored financial planning

The first (and most important) thing we do with our clients is to develop a big-picture strategy that is aimed at meeting their goals sooner, more easily, and with less stress. This strategy considers all aspects of your financial affairs, such as investments, property, businesses, debt, superannuation and budgeting, and provides important clarity for the client and their Adviser.

Investing

We take a highly considered and structured approach to investing that helps our clients to achieve their financial goals, while also considering their risk and investment preferences. Our investment philosophy also allows clients to benefit from inevitable market cycles, without relying on making forecasts or predictions.

Cash flow utilisation

Correctly managing cash flow is an often over-looked but critical factor in wealth accumulation. We work with clients to ensure they are allocating their surplus cash flow in the most appropriate direction, taking into consideration investment opportunities, debt and tax. We also help to automate this process.

Superannuation & SMSF advice

Superannuation is an excellent structure to invest in, with low tax rates and the potential to significantly impact your wealth. We work with our clients to ensure they make the most of the significant contribution, investment, and withdrawal strategies available to maximise wealth.

Tax minimisation

Nobody wants to pay more tax than they need to. It is important to ensure your investments are structured appropriately to optimise your after-tax returns. Our approach ensures that clients take advantage of a range of opportunities to minimise unnecessary taxes and risks within their portfolio.

Personal insurance

We work with our clients to ensure they have the right level of life, TPD and income protection insurances, and help find the right balance between required cover and cost. Because we don’t accept any commissions, our clients typically benefit from significant discounts on their insurance costs.

Retirement planning

Retirement planning is less about leaving work, and more about gaining financial independence so that you have the option to do what you want in life, when you want. We provide advice to help maximise your financial position in, and leading up to, retirement.

Estate planning

Ultimately, estate planning is important to ensure that your beneficiaries are appropriately looked after when you are no longer here. We consider the financial aspects of your estate planning and project manage the entire estate planning process so you can protect your loved ones.

Property advice

We provide advice regarding residential and commercial investment properties, considering all aspects from cash flow to debt and tax. We help our clients to ensure property purchases and sales support their overarching plan and longer term financial goals.

Sounding board

We provide our clients with a sounding board for all decisions that can affect their financial position. We always welcome phone calls from clients to sense check ideas, opportunities or concerns, and actively help them make the right financial decisions.

A ‘hub’ for your financial affairs

We work closely with your other advisers, for example accountants and lawyers, to ensure all of your affairs are cohesive, and that all aspects of your situation are considered in our planning.

Facts & figures

Numbers that speak for themselves

Finding the right Financial Adviser can have a huge impact on your financial position. Oxlade Financial has proven performance.

Our clients

Our clients range from Doctors, to business owners and professionals, to retirees

They engage us because they want to maximise their financial position, now and for the future, and because they want someone to actively manage wealth creation for them.

Doctors

A large group of our clients are medical professionals. Doctors have unique financial planning requirements – they are very busy and need to be able to reliably outsource, they have often complex work arrangements, and they typically have specific & high insurance needs. We work with Doctors to intimately understand their entire situation, and then provide holistic, tailored advice to maximise their hard-earned wealth.

Business owners

We are also proud to work with many small to medium sized business owners. Having personally owned small businesses ourselves for a number of years, we have first-hand knowledge of the complexities and pressures that come with business ownership. We work with business owners to intimately understand their personal situation, and help them achieve their personal financial goals as quickly as possible.

Professionals

Busy Executives are typically time pressured, but want and need advice that allows them to capitalise on their career success. We work with these clients to identify their financial goals, and develop tailored strategies that best support the achievement of these. Executive clients typically appreciate very clear and direct advice that allows them to maximise their wealth position whilst having more head space for the other important things in life.

Retirees

We also look after many retired clients, or clients preparing for retirement in the next 5-10 years. These clients want to ensure that their financial position and independence for the future is maximised. By intricately understanding these clients’ needs and goals, we develop tailored advice that allows them to enjoy and make the most of their money at this lovely time of life.

The ultimate benefits of great advice

Customised, independent financial advice to help you enjoy more of life, with less worry

01

Maximise

your wealth

Get the most out of your money, without having to manage it all on your own

02

Create lasting

independence

Set you and your family up for long-term financial success so you can enjoy freedom & flexibility

03

Expand

your options

Give yourself the gift of choice so you can design & live your life in any way that you want

04

Build your

impact & legacy

Use your money as a powerful resource to support the people and causes you care most about

Maximise your wealth

Is your money working hard enough for you?

We exist to maximise our clients’ wealth, and to help you make the most of your money. Tailored advice that makes your money work hard can ultimately have a huge impact on your financial trajectory.

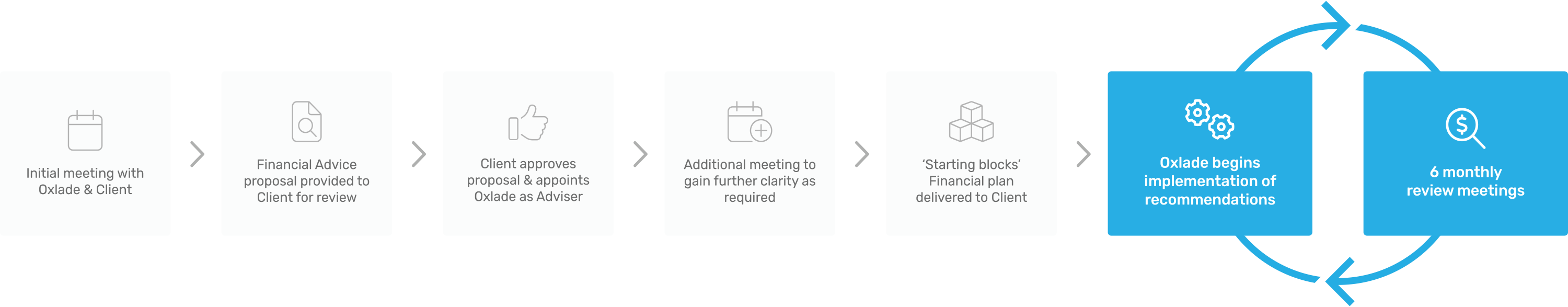

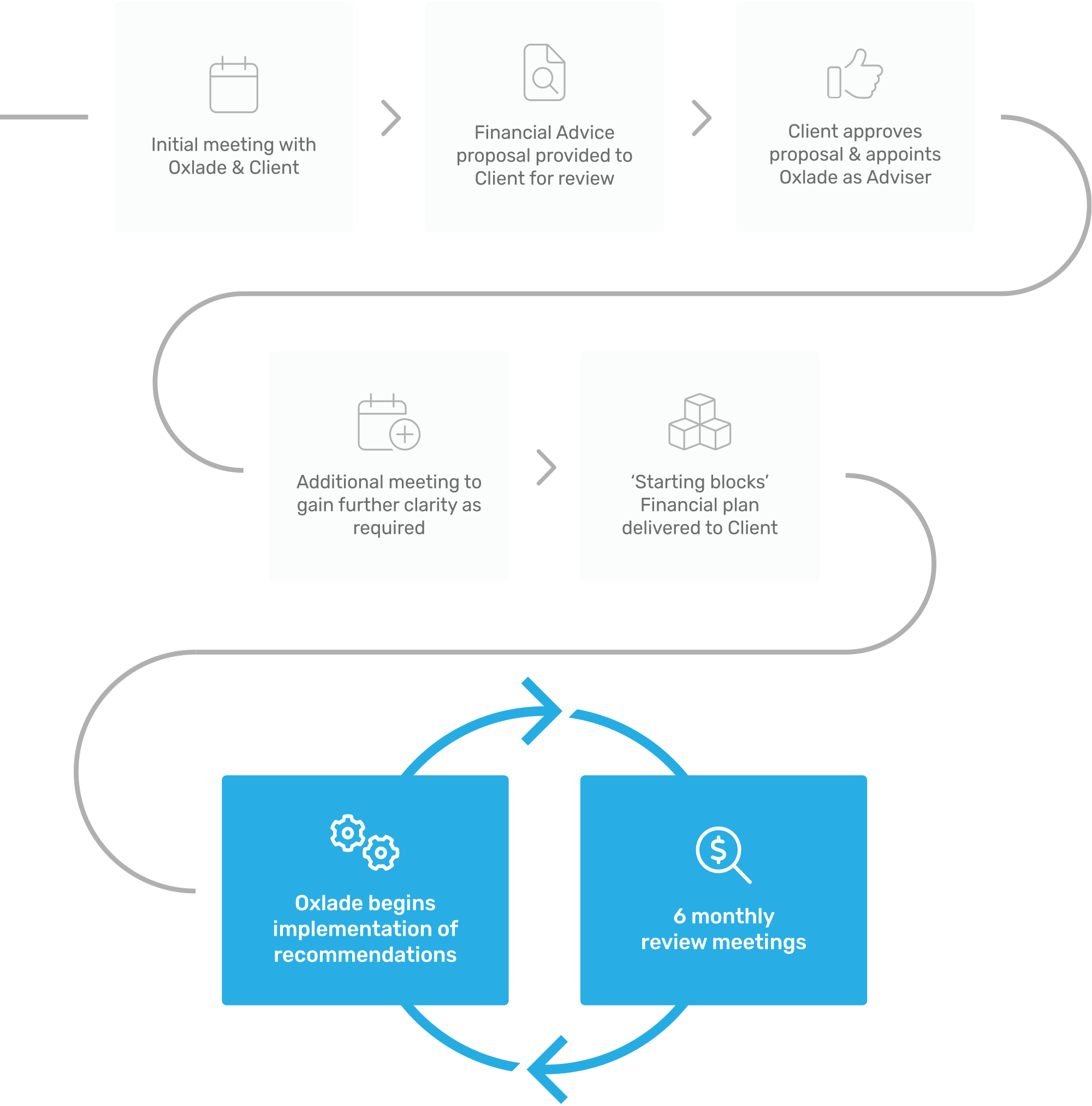

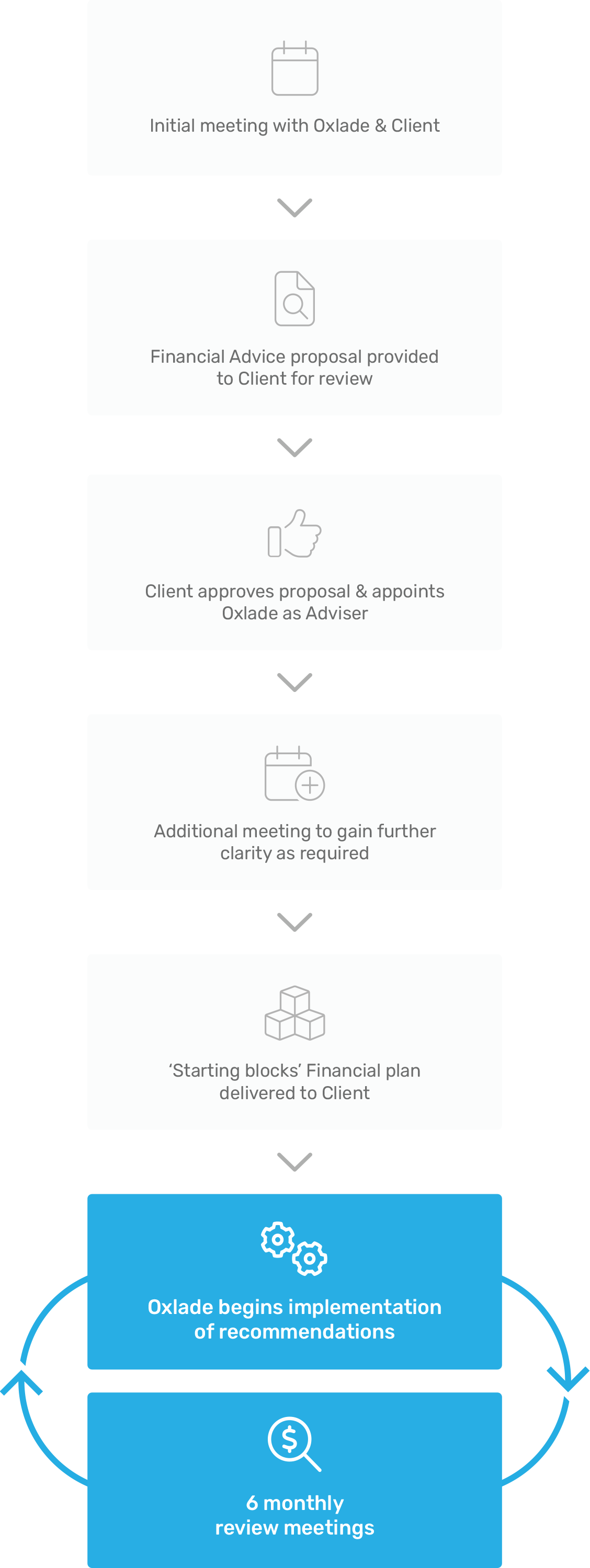

Our advice process

Every Adviser has a different process for working with clients.

Below is the process that we use at Oxlade Financial to ensure effective, highly tailored and proactive advice for our valued clients.