In the world of investing, one unsung hero often lurks in the background: time.

When life gets busy, it is easy to put aside things that aren’t urgent, even if important. One of these things, for many people, is investing and getting on top of finances.

When it comes to investing, conversations often revolve around market trends, is a recession around the corner, should I buy this particular stock, or opportunities. While these aspects hold significance, there’s a hidden opportunity that often goes forgotten, despite its’ immeasurable importance: time. In fact, the most undervalued asset in investing isn’t a stock or a particular investment — it is the time you give your investments to grow and flourish.

Put simply, getting started as early is possible is critical, and likely more influential than how you invest.

Take 2023 for example

If we look at the 2023 year, as an example, to illustrate the point.

Despite looming reports of a recession throughout the year, the S&P500 generated a return of 18.20%* when reviewing YTD performance (as at 23/11/2023).

If you’ve been too busy to begin investing, unfortunately this is the potential opportunity cost. Whilst it hurts, the key thing is to avoid it happening again year on year.

But it’s bigger than just the lost returns in a year: The power of Compound Interest

Much more than just the lost opportunity for year 1, compound interest is significantly more influential.

Compound interest is like a snowball effect, gaining momentum as it rolls downhill. What it means is this: The longer your money stays invested, the more pronounced this effect of returns become, as your initial investment will continue to grow with re-invested earnings. It’s not just about what you invest; it’s about the time you allow it to thrive.

If we take the US share market, as another example, returns averaged ~10% per annum between 1970 and 2020. Each year in isolation represents a solid result, but the cumulative return over this entire period was 11,600% – a significantly more impressive outcome, and one that saw the share market return significantly higher returns than other asset classes.

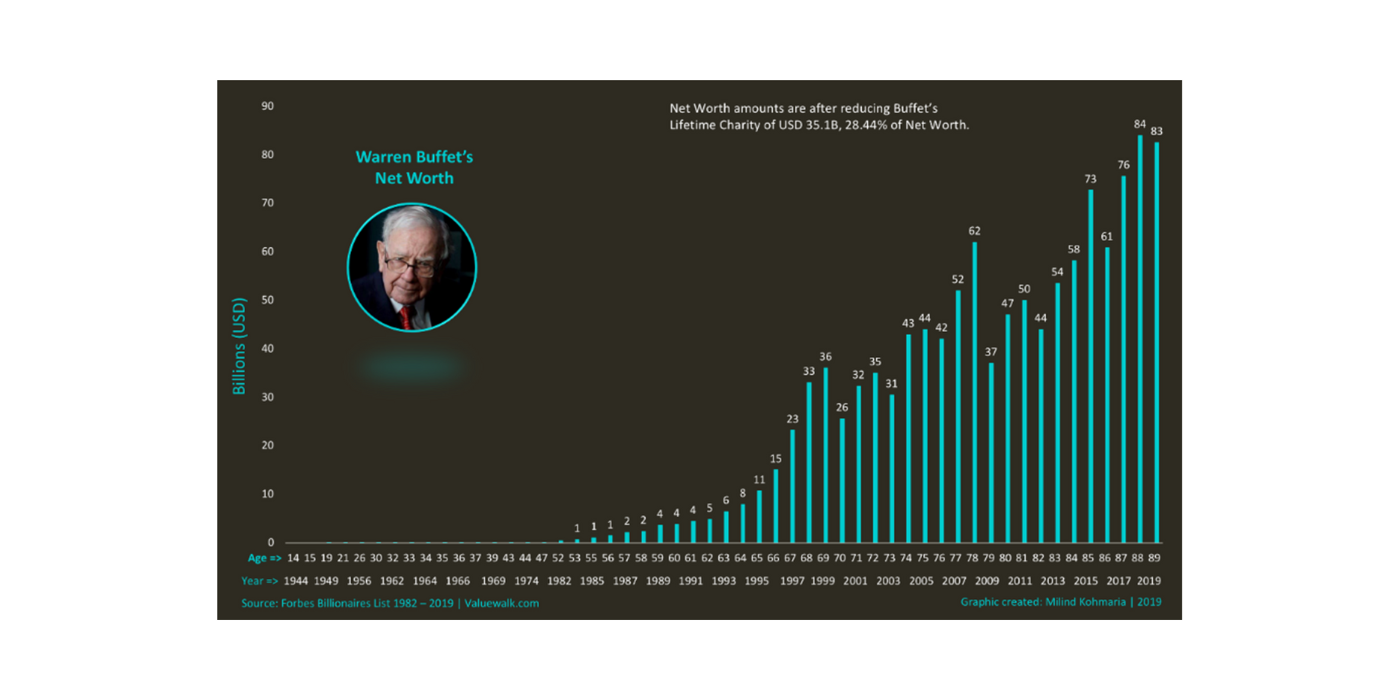

This result is well illustrated in the below graph that shows Warren Buffet’s net worth accumulation over time.

Source: Forbes Billionaires List 1982-2019

The importance of patience

In today’s fast-paced world, instant gratification often overshadows the beauty of patience. Investors tend to get anxious, reacting to short-term market fluctuations. Yet, history has shown that markets, despite their fluctuations, have trended upwards over the long-term. By embracing a patient approach, investors can leverage time to their advantage.

Mitigating risk

Time also acts as a shield against market volatility. It provides a buffer against the ups and downs of the market. When you have a longer investment horizon, the impact of market downturns becomes less significant.

Achieving your goals

Investing isn’t just about accumulating wealth – it is about achieving your goals, like purchasing a property, funding education, or retiring comfortably. Time is the ally that helps in planning, executing, and ultimately achieving these goals. Starting sooner gives the advantage of ample time to accumulate wealth.

Time: The unsung hero of investing

In our fast paced world where instant gratification is expected, the most ignored aspect of investing is time. It’s the most potent yet underrated factor that can significantly amplify the growth of your investments.

So, next time you ponder your investment strategy, remember: time isn’t just money; it’s the invaluable catalyst that can make your financial goals a reality.

Invest wisely, invest patiently, and let time run its course.

If you need advice regarding your investments, or have any questions on this article, please contact our office to speak with one of our Advisers.

Any information in this article is general in nature and does not consider any of your personal objectives, financial situation and needs. It is as intended, to be of a general nature only and NOT a recommendation to you. You should consider whether the information is appropriate to your needs, and where appropriate, seek personal advice from a registered financial adviser.