The economic and financial climate has certainly been uncertain in recent times. Naturally, this does worry many investors. However, the reality is that when markets are very strong, and investors are feeling the most excited and optimistic, great investment opportunities are scarce.

On the flip side, in times of uncertainty, there are more opportunities. It is generally far better to invest when things are uncertain, and people are feeling concerned. The trick, of course, is having a strategy and a plan, and staying the course.

Below are 6 simple tips for investing that will help you navigate volatile times.

1. Have well defined goals – how much will this cost and when

Successful investing is a matter of marrying up when you expect to need money with the right investments.

If you need money in the short-term for things like a house deposit, new car, living expenses or a wedding, it is typically best to invest these funds in low risk, liquid investments that will be available to quickly fund these expenses as they arise.

If you don’t need the money in the near term, then putting your money in longer term investments like shares and property is generally a better plan. These investments have the potential to generate higher, but more volatile, long-term returns, and will help offset the impact of inflation and meet your long-term term goals.

Put simply, having well defined goals that include specific amounts and timelines will help you to map out where you should invest your money.

2) Stick to the long-term plan and remain invested

One of the key reasons to have a financial plan is to weather volatile times, like what we are experiencing now. Yet often it is during the volatile times when long-term plans are abandoned, with the single biggest issue being the panic sale of investments after markets decline. Investors often comment that they will ‘get back in when things settle down’.

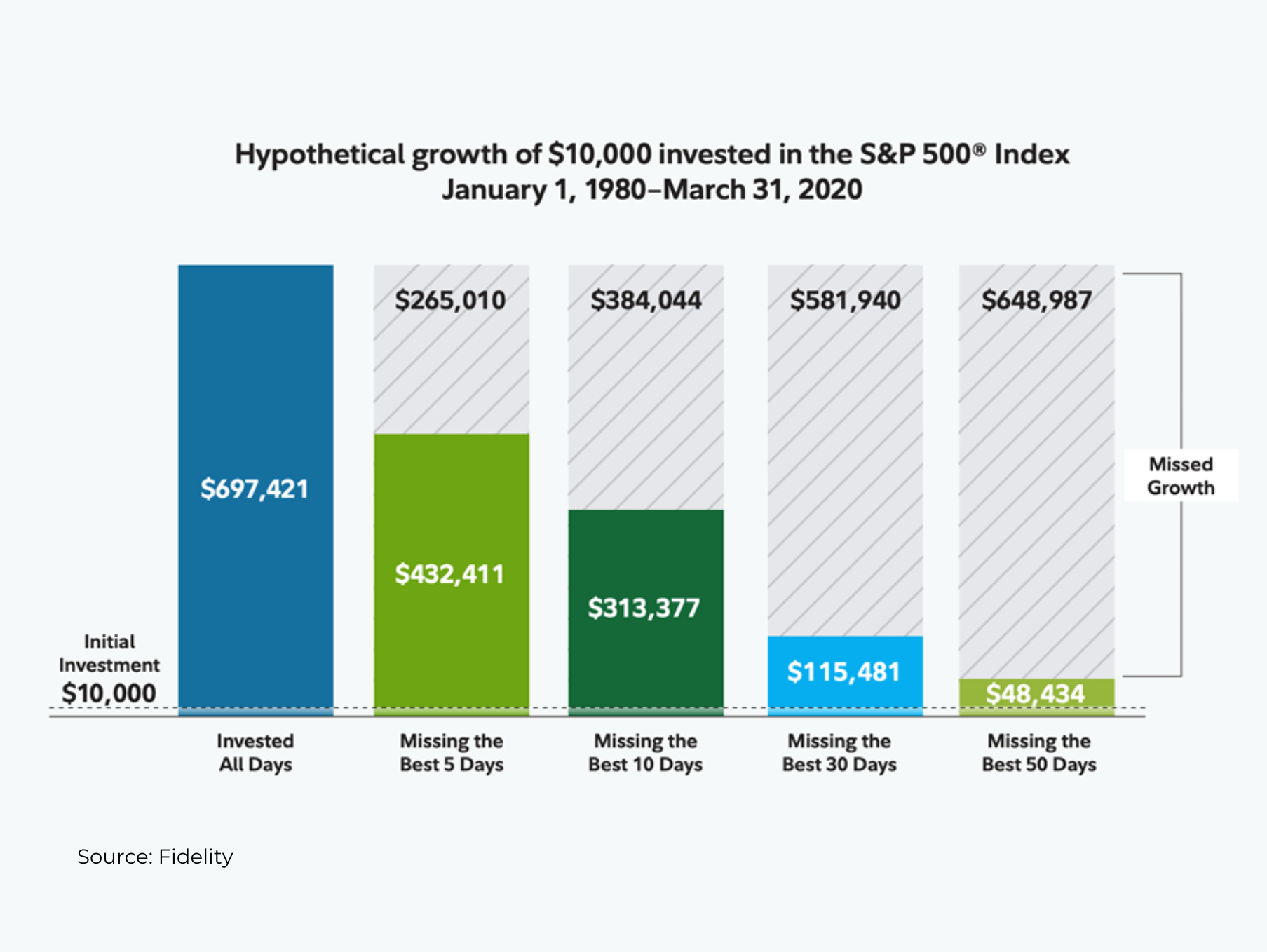

However, history has shown that market declines are temporary, and that after every sell off, there has been a recovery. Further, often the early part of the recovery is the sharpest. Therefore, those that sell out often do at a low point and lock in a loss, and then miss the recovery, meaning that they end up in a worse off position than they would have if they had done nothing at all.

Ultimately, it is riskier to sell out of a diversified portfolio of investments to instead invest in cash, than to remain invested.

In the chart below, Fidelity show that missing out on just a few of the best days in financial markets can substantially lower your long-term returns compared to just remaining invested.

3) Don’t chase last year’s winners

Every year the best performing funds advertise last year’s great returns. But almost every year, the best performing funds change.

Investment research generally shows there is little benefit in choosing funds based on strong historical returns. In fact, strong historical returns could even be detrimental, given that often the funds that do the best in one period, then often underperform in the subsequent period.

Of course, this sometimes goes the other way, with underperforming funds in one period then seeing a period of subsequent strong outperformance.

What this all means is that switching your money from an underperforming investment to one that has recently performed will likely be detrimental – effectively selling low and buying high!

Instead, if you have underperforming investments, take the time to understand why this is case. If the decline is likely temporary or caused by some short-term issue that will resolve itself in time, there might be an opportunity to add to the investment at a lower price, rather than to sell it.

Disciplined rebalancing of portfolios should see money flowing out of recent winners into investments that haven’t done as well recently.

4) Maintain diversification – don’t put all your eggs in one basket

Lack of diversification across various investment types, asset classes, industries and companies adds unnecessary investment risk. Different investments perform well at different times, so having a mix of investments helps improve long-term returns and smooths out the fluctuations.

Diversification is the way to minimise or eliminate these risks.

A well-diversified portfolio significantly reduces the impact of being too exposed to any one factor. Ideally, you should ensure that you are adequately diversified by holding different assets (cash, fixed interest, property, and shares both in Australia and overseas) and that within each sector you also hold a diverse range of assets. This eliminates the possibility of a single asset having a catastrophic effect on your overall financial position.

5) Understand your risk profile and have a plan to manage risk.

Prior to investing, it is extremely important you assess your long-term risk profile and have a risk management plan in place for when financial markets decline, because like it or not, these declines are a normal part of investing. Any risk management plan includes having a cash reserve for those lumpy unforeseen expenses that arise from time to time in life, and having some investments easily accessible in lower-risk environments for money needed in the short to medium term.

Importantly, assessing one’s risk tolerance, and quantifying what the range of historical returns have looked like, will help you understand what you are in for in the future, and reduce the likelihood of you wanting/needing to sell off investments for fear of market declines. Conversely, it will also help you avoid being too conservative, and subsequently missing out on long-term upsides that financial markets can also deliver, with the only way to then catch these up being via increased saving (and less spending!).

6) The more you look, the more volatile it is. Read something else.

Finally, there is really no value in looking at your portfolio 10 times per day, apart from getting a dopamine hit!

The more times you look at your portfolio, the more volatile it will appear, and the more likely you are to make a behaviour error that will be detrimental to returns.

Instead, you are much better off looking at your portfolio less frequently and using the time to enjoy life or to read something informative that may help make better investment decisions going forward!

Investing well can obviously have a hugely beneficial impact on your long-term wealth creation. Times of uncertainty are par for the course, as are periods of exciting growth.

Ultimately, having a plan and staying the course is your best bet, and will ensure you can not only weather any storms, but also maximise your long-term returns.

These tips should be helpful as you seek to weather the current uncertainty. Of course, the right course of action for you is entirely dependent on your personal situation and goals, and your trusted adviser will be able to make specific recommendations for you on these fronts.

If you want further clarification or do need any investing advice during this time of volatility, please don’t hesitate to contact our team on 07 3667 7260 or email info@oxlade.com.au.

Any information in this article is general in nature and does not consider any of your personal objectives, financial situation and needs. It is as intended, to be of a general nature only and NOT a recommendation to you. You should consider whether the information is appropriate to your needs, and where appropriate, seek personal advice from a registered financial adviser.