Superannuation is one of the most powerful tools that we have access to for wealth creation, however most people tend to neglect it due to the delayed benefits. Whilst superannuation may not feel like a current priority, decisions made today can have a massive and lasting impact on your long-term financial position.

Here’s why superannuation is super…

The power of compounding

Superannuation represents the perfect environment to utilise compounding.

Compounding is the process where earnings on your investments, such as interest or returns, are reinvested to generate additional earnings. It means that your money grows faster over time as you keep reinvesting what you’ve earned.

Because of compounding, the growth of your super balance accelerates as earnings on the investments generate additional returns. Put simply, this means that the earlier you start contributing to super, the greater potential there is for wealth accumulation.

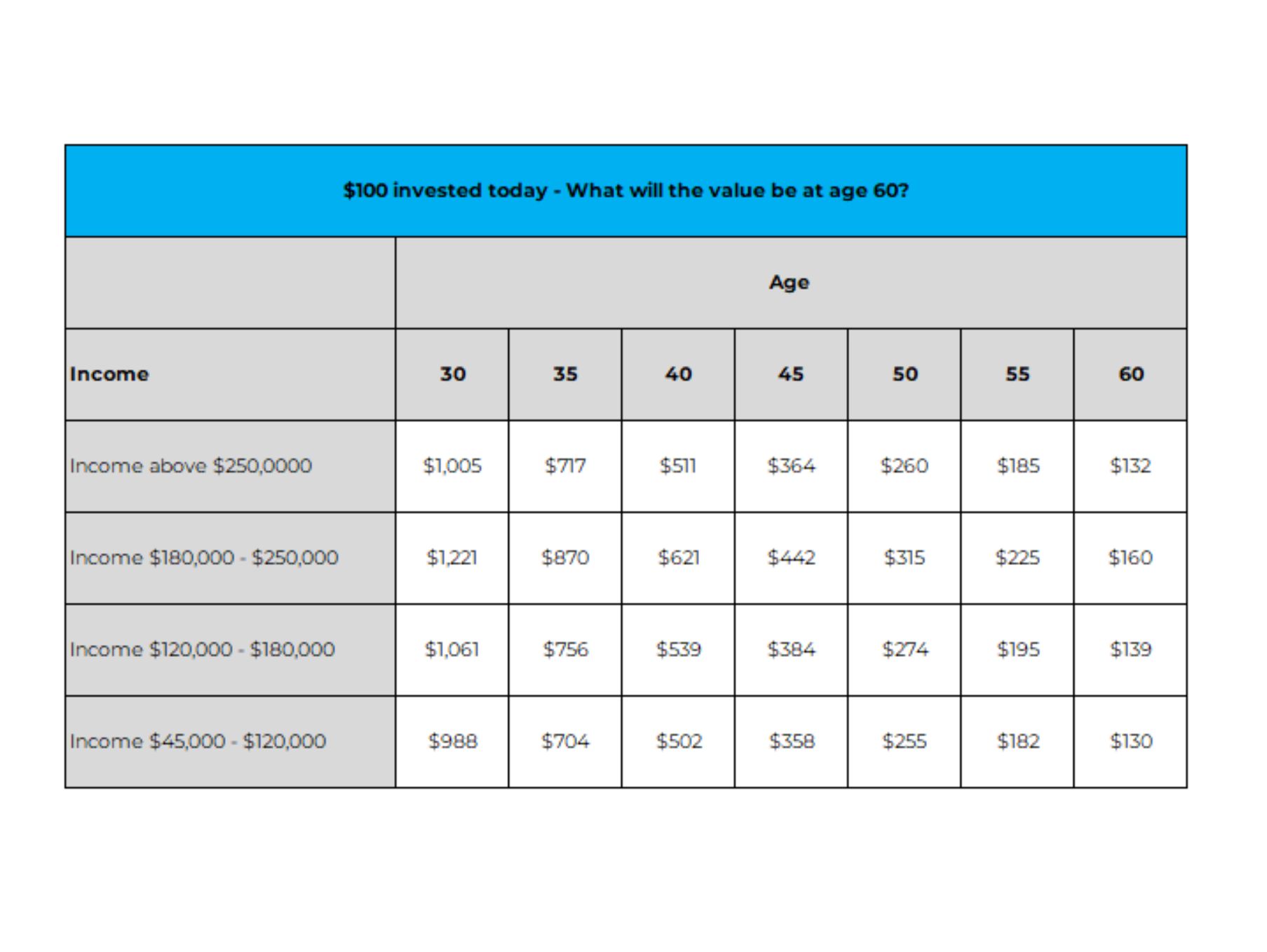

The below table demonstrates the true power of compounding. It shows what the value of $100 today will become at age 60, based on your current age and income (assuming an 8% pa return).

To illustrate the point, $100 invested into super today by a 30 year old with an income between $180,000 and $250,000 is expected to be worth $1,221 when that person is 60.

By comparison, $100 invested at age 45 on that same income will be worth only $442 – 1/3 of the end value. Investing early truly does have a significant impact on your long term wealth.

Tax advantages

Superannuation enjoys favourable tax treatment, making it an attractive tool for wealth accumulation.

Within superannuation, earnings & growth are taxed at a maximum of 15%. This is attractive when compared to marginal tax rates that range up to 47%, depending on your income. Funds invested in superannuation are therefore often much better placed to benefit from investment returns.

When it comes to contributions, individuals currently have access to the concessional (tax deductible) contribution cap of $27,500 p.a. (increasing to $30,000 p.a. from 1 July 2024). This cap represents the maximum amount that an individual can contribute to super pre-tax. Your employer contributions fall into this category, as do salary sacrifice & personal deductible super contributions. Maximising these, where your position allows, is therefore a tax-advantageous way of growing your retirement fund. Therefore, the tax benefits are two fold being (1) you get a tax deduction for putting the money into to super and (2) the money is then invested at a very low rate.

You can take this one step further also, with the ability to make use of prior years’ unused contribution caps, which can provide additional tax benefits. What this means is that if you haven’t made the maximum allowable contributions to super in the past 5 years, there is some provision to allow catch up contributions to be made to boost your super. Relevant catch up contributions are taxed within your super fund at 15%, and are then eligible for a tax-deduction also, meaning that there is plenty of tax upside if you are eligible and in a position to make catch up contributions.

Finally, it is worth noting that when the time does come to access funds in super, this can be done via pension phase, providing a completely tax-free environment for your wealth to be held.

Optimised investments

For many Australians, a superannuation account is established when entering gainful employment and is often never looked at beyond this point. However this is typically a mistake.

How your superannuation is invested can make a substantial difference to the value of your super balance in the long run. Taking the time to understand and optimise the investments within your superannuation, as well as understanding the relevant fees/costs, can ultimately change the trajectory of how your super performs. Diversification is important, as is tailoring your super to align with your risk tolerance and financial objectives.

Realistically, the way your super is invested should be given as much (or more) thought than you would give to how you invest outside of super.

Many prospective clients we talk to have made the mistake of forgetting super because it doesn’t seem like something that is of immediate benefit or relevance.

By recognising its significance, and the impact it can have on your financial position, your long term wealth and financial independence will be much better off. As with all things investing, taking the right steps today can truly have a significant impact for tomorrow.

Any information in this article is general in nature and does not consider any of your personal objectives, financial situation and needs. It is as intended, to be of a general nature only and NOT a recommendation to you. You should consider whether the information is appropriate to your needs, and where appropriate, seek personal advice from a registered financial adviser.